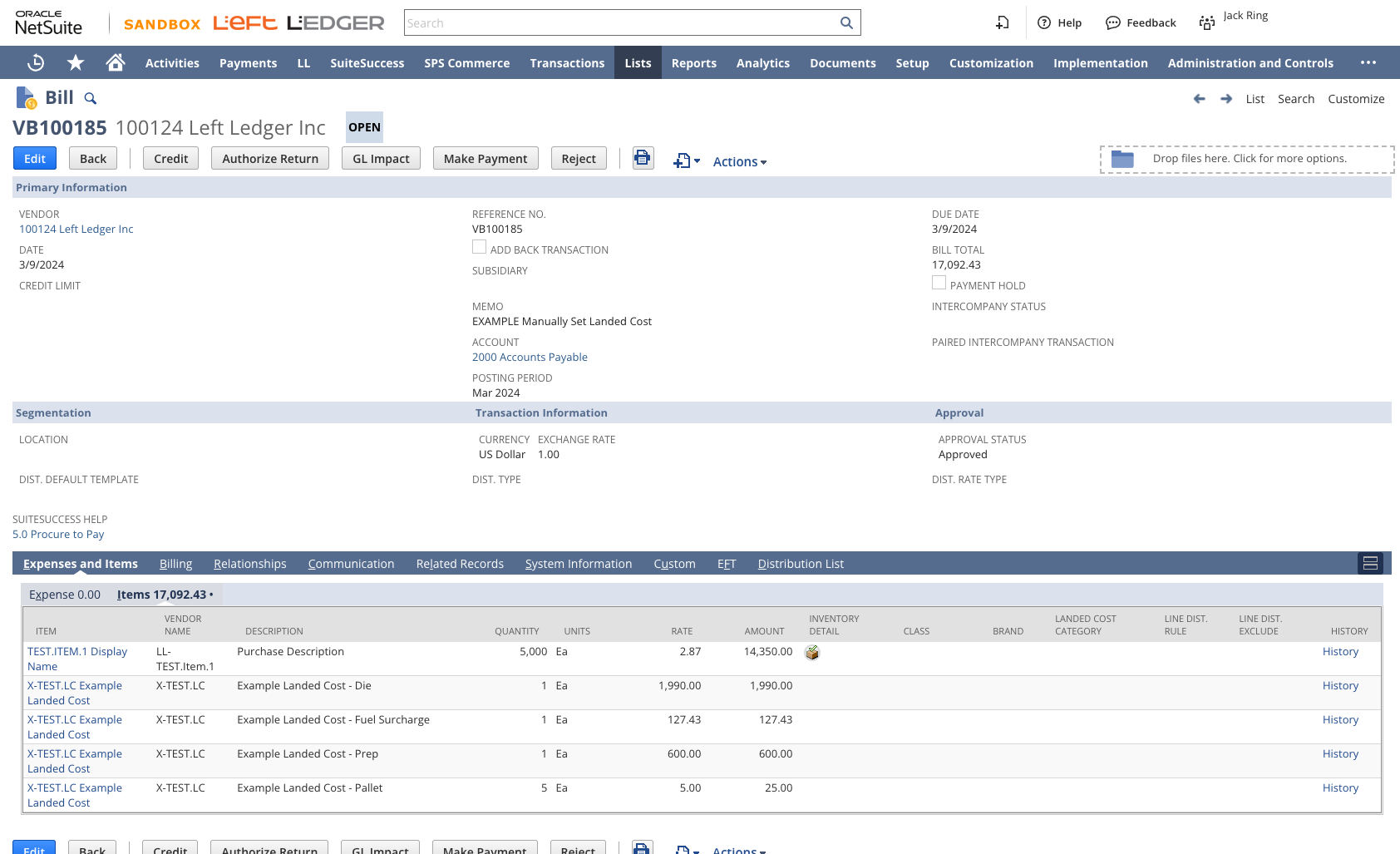

Source Landed Cost from PO then Enter Directly on Item Receipt

This is an article which discusses a method to leverage NetSuite’s Landed Cost feature. Companies sometimes want to recognize expenses related to the purchase process for an item into the value of an item. This allows those related costs to be held on the balance sheet and expensed progressively with the sale of each unit to end customers.

The method discussed in this article is basic and flexible but also somewhat prone to user error. It involves manually entering landed costs directly on an Item Receipt transaction.

Method #2. (Also see method #1)

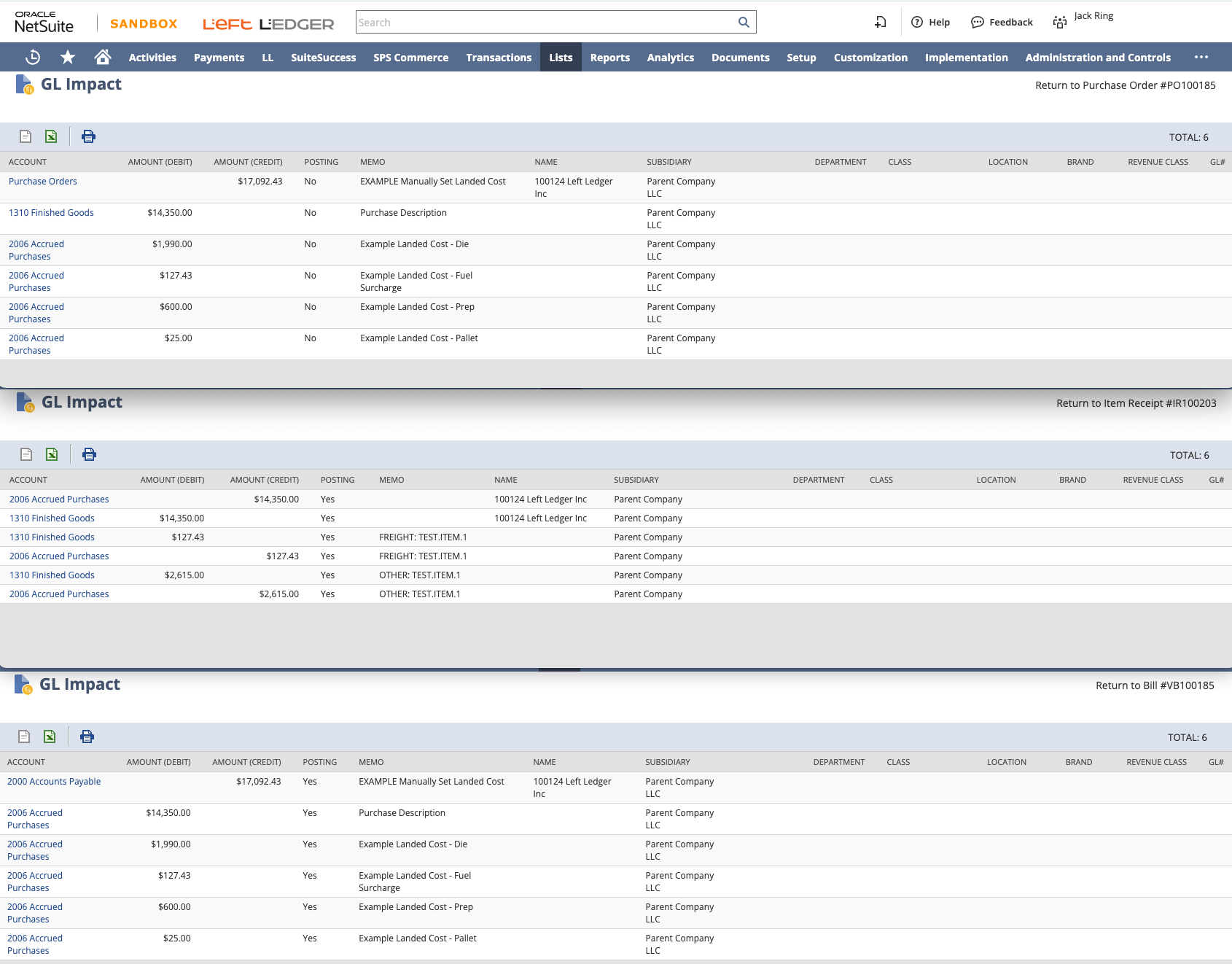

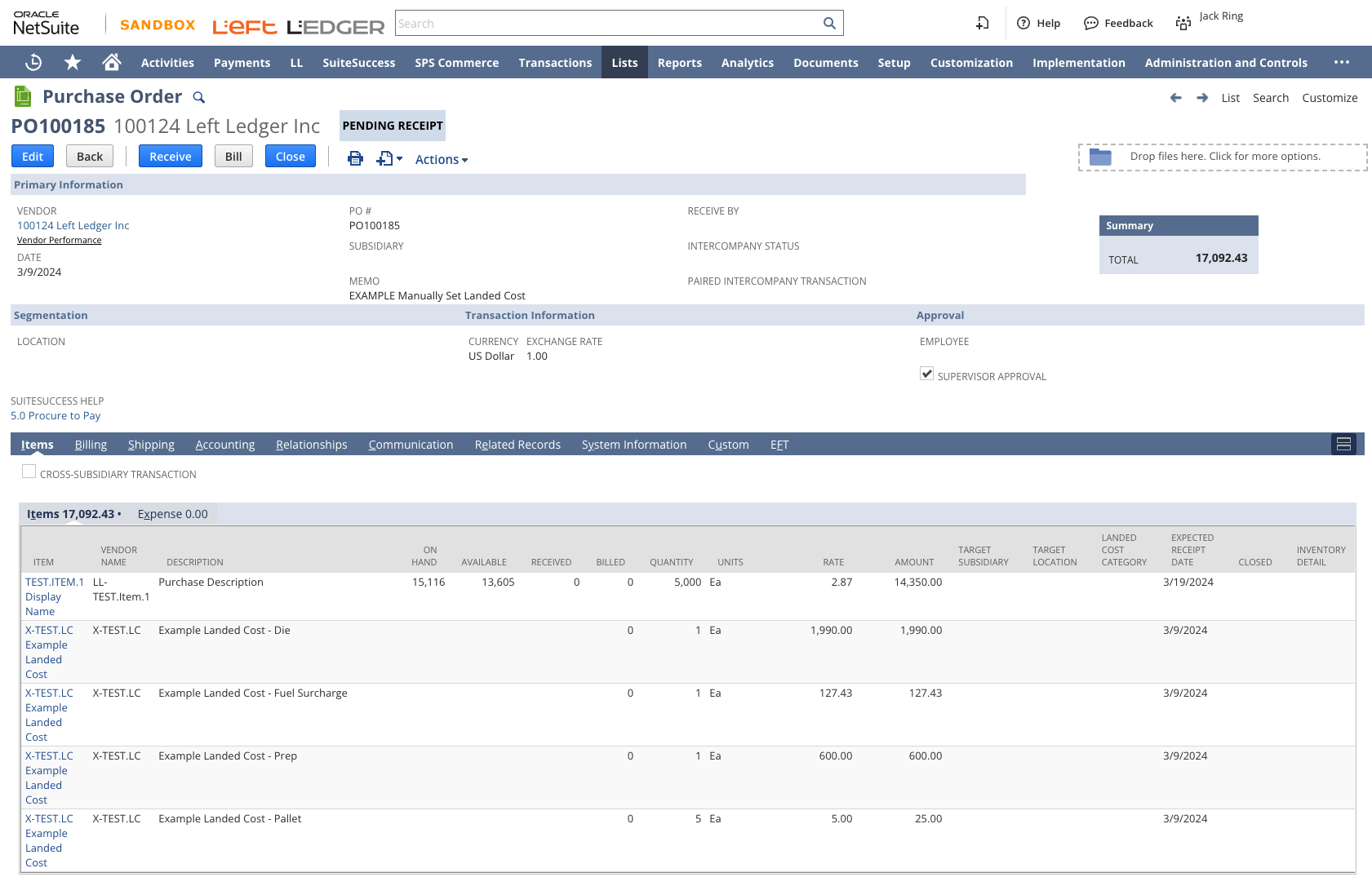

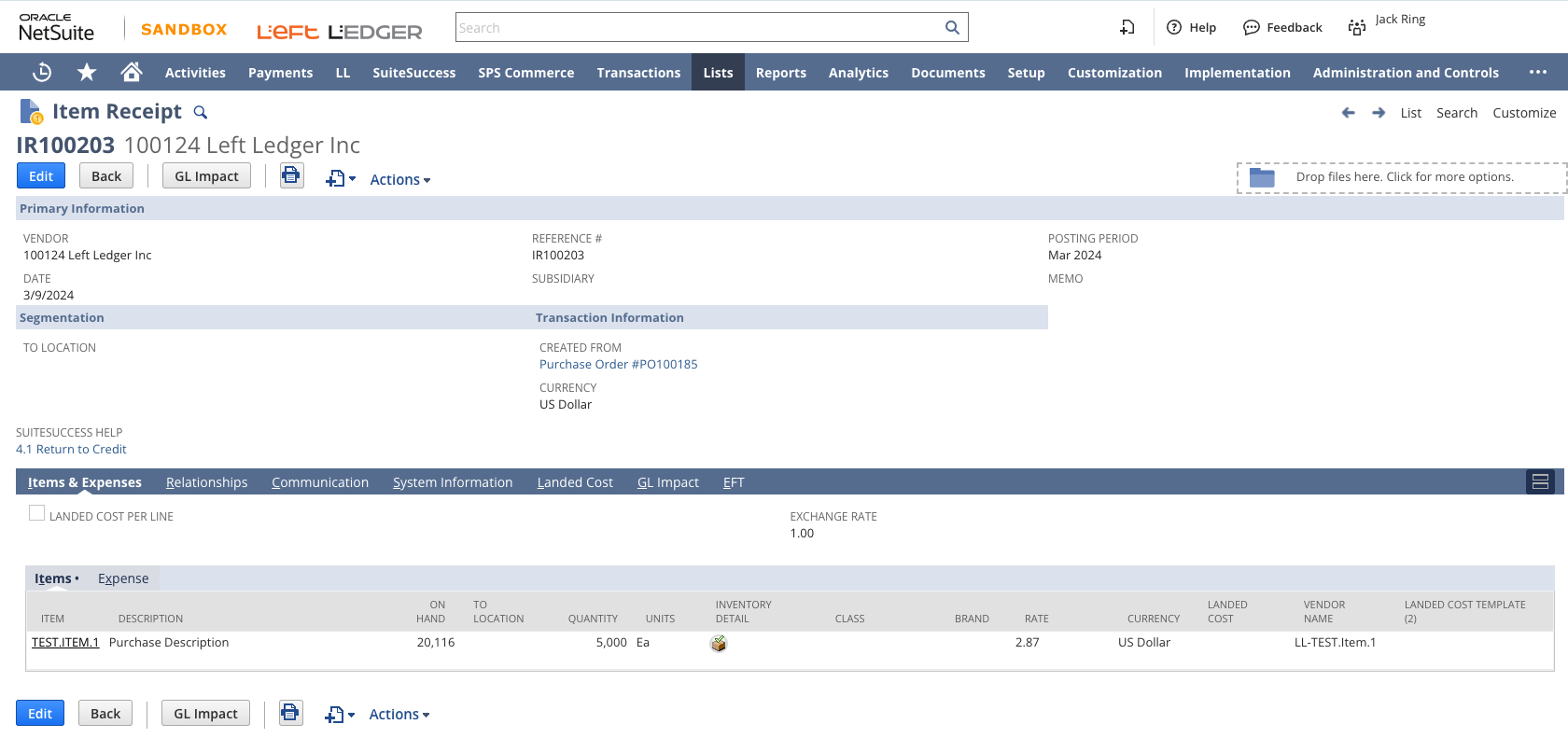

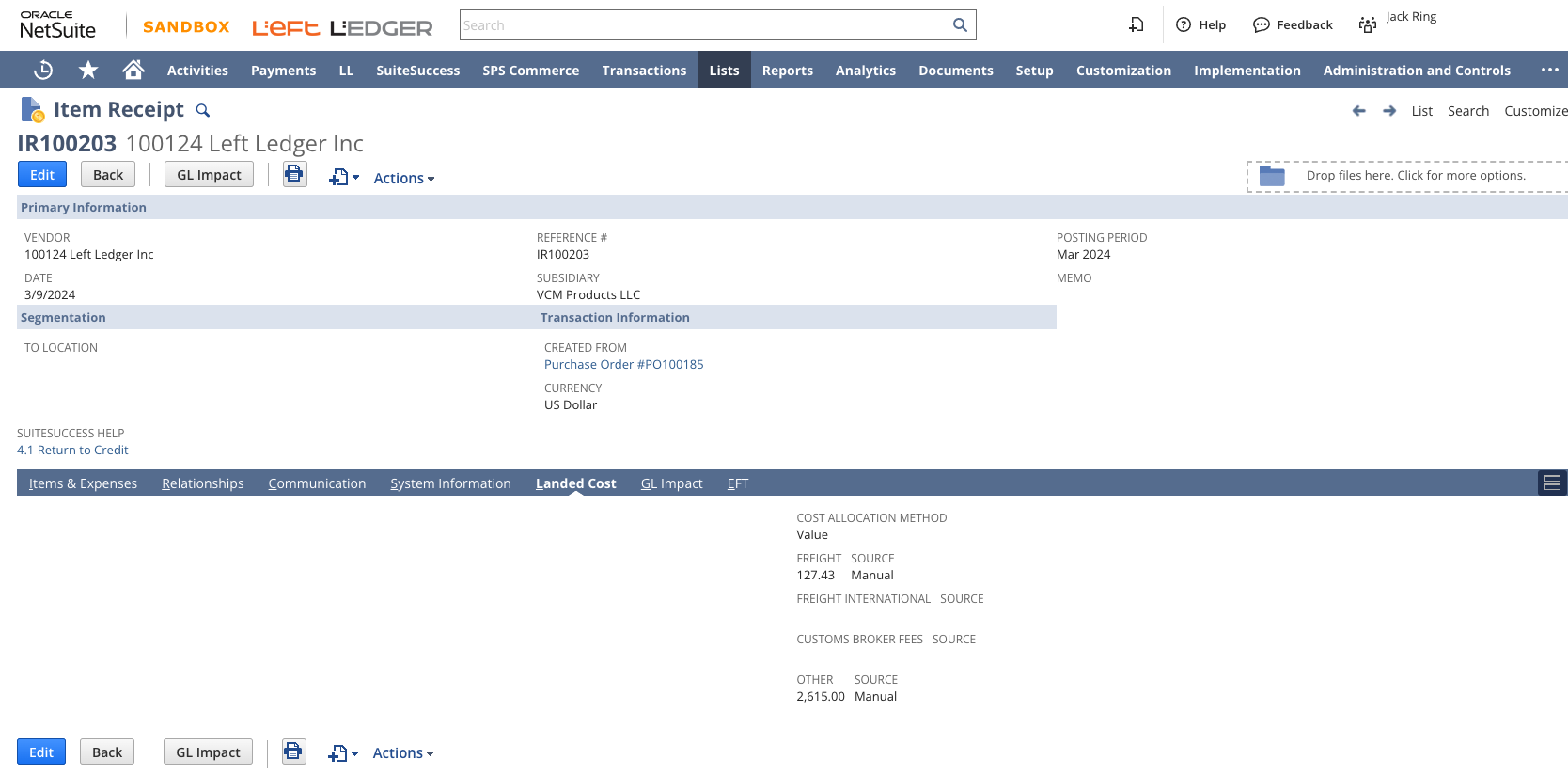

At the time the items are received, on the Item Receipt, visually source the landed cost amounts from PO, enter landed cost values to each Cost Category "Manually".

Drawback #1.

End user may make a mistake in referencing expenses from PO and calculating - resulting in a delta in 3-way matching between [PO, IR, VB]

Drawback #2.

End User may come back and take liberties "RE" editing landed cost on the IR. If this happens after the previously-received units are on other transactions, a COGS variance may occur.